1. Introduction

Generally, when a company in Malaysia winds up and the wages and salaries of its employees remains unpaid, this begs the question of whether the directors or shareholders of that particular company can be held personally liable for those unpaid wages?

Under Malaysian law, company directors will not be personally liable for any unpaid wages owed to employees. Therefore, your only recourse against your employer would be to file a complaint with the Labour Department if your employer fails to pay your salary within seven (7) days after the last day of the salary payment period as per Section 19 of the Employment Act 1955 (“EA 1955”). You may lodge a complaint by:

- Writing to or visiting your nearest Department of Labour (Jabatan Tenaga Kerja [JTK]) office;

- Writing to the Department of Labour’s official email at jtksm@mohr.gov.my;

- Making a query via the Department of Labour’s Public Complaint Management System (SISPAA);

- Calling 03-8000 8000 (Malaysia Government Call Centre [MyGCC]);

- Making a Working for Workers (WFW) application.

2. Employer Insolvency

However, in the event of insolvency or winding up of the employer company, and in situations where a receiver or both a receiver and a manager is appointed, then considerations of Section 31 of the EA 1955 and Section 526 of the Companies Act 2016 (“CA 2016”) will be required when determining the priority of the payment of unpaid wages or debts in the event of a company winding up or liquidation.

Section 31 of the Employment Act

Section 31 of the Employment Act 1955 and as confirmed in the case of Perwaja Steel Sdn Bhd v RHB Bank Berhad & Ors [2019] 5 AMR 342 provides that payment of four (4) consecutive months of employees’ wages and statutory payments have priority over other debts (even a secured creditor’s debt). However, there is a caveat to this – the priority of wages provided under Section 31 will only apply in very specific circumstances – namely where there is a sale of a place of employment on which an employee to whom wages are due was employed or worked at, at the time when such wages were earned.

- Whilst there is a maximum on the amount of unpaid wages (i.e. 4 months of unpaid wages) for an employee who enjoys priority under Section 31, there is no limit on the amount of statutory payments claimable or payable to the employee.

- The employee does not have to be working at the land in question at the time of the sale for Section 31 to apply. As long as the employee(s) had worked at the place of employment being sold and that their wages are due, their outstanding wages and statutory payments will have priority over secured creditors

Therefore, in the event of a company’s insolvency or winding up, a receiver was appointed and the selling of the company’s charged assets (ex: the office or the factory of the company – which are “places of employment” being sold) comes into play, the receiver will have to make payment of up to four (4) months of wages as well as any unpaid statutory payments (such as EPF, SOCSO etc.…) to the employee(s) whose wages are due from the proceeds of the sale of the charged assets first. Once the employee(s) unpaid wages and statutory payments are settled, only can the secured and unsecured creditors receive the proceeds in accordance with the priority of unsecured liquidation debts under Section 527 of the CA 2016.

Section 527 of the Companies Act 2016

If the above scenario does not apply, then the priority of payment in respect of all other unsecured debts in a winding up under Section 527 of the CA 2016 will be considered. Once the winding up of the company has been approved by the Companies Commission of Malaysia, there is a priority of debts that are to be paid (and in the following order):

- Secured Creditors under a fixed charge (such as banks);

- Preferential Creditors/ Unsecured debts (this is where Section 527 comes to play)

- The costs, charges, and expenses of winding up (including the liquidator’s fees and costs of any audit).

- All wages or salary up to the sum of RM15,000 (per employee) for services rendered to the company within a period of four months before the winding up order.

- Employee’s compensation accrued before the commencement of the winding up.

- Statutory payments (Ex: Leave that was not taken by employees).

- Employee contributions (EPF, SOCSO, EIS).

- Federal taxes, including goods and service tax that is owed to the government.

3. What should I do when my employer fails to pay my wages

If your employer is still operating:

- Discuss/ come to an agreement/ mutual understanding with your employer;

- Lodge a complaint with the Labour Office. A mention date will be fixed before a “Labour Court” where a Labour Court Official will attempt to resolve your complaint(s) or dispute(s) with your employer. Your employer may concede the claim or the parties may come to an agreement.

- If the issue cannot be resolved at the Labor Department level (ex: where your employer/company denies your complaint(s) or claim(s), the unsettled complaint will be referred to the Industrial Court by the Director General of Industrial Relations.

- If you are unsatisfied with the outcome of the Industrial Court’s decision, you can appeal the award to the High Court within fourteen (14) days of the award.

- If all else fails, pursue a civil claim in the Sessions Court or the High Court (depending on the amount involved) to recover unpaid wages

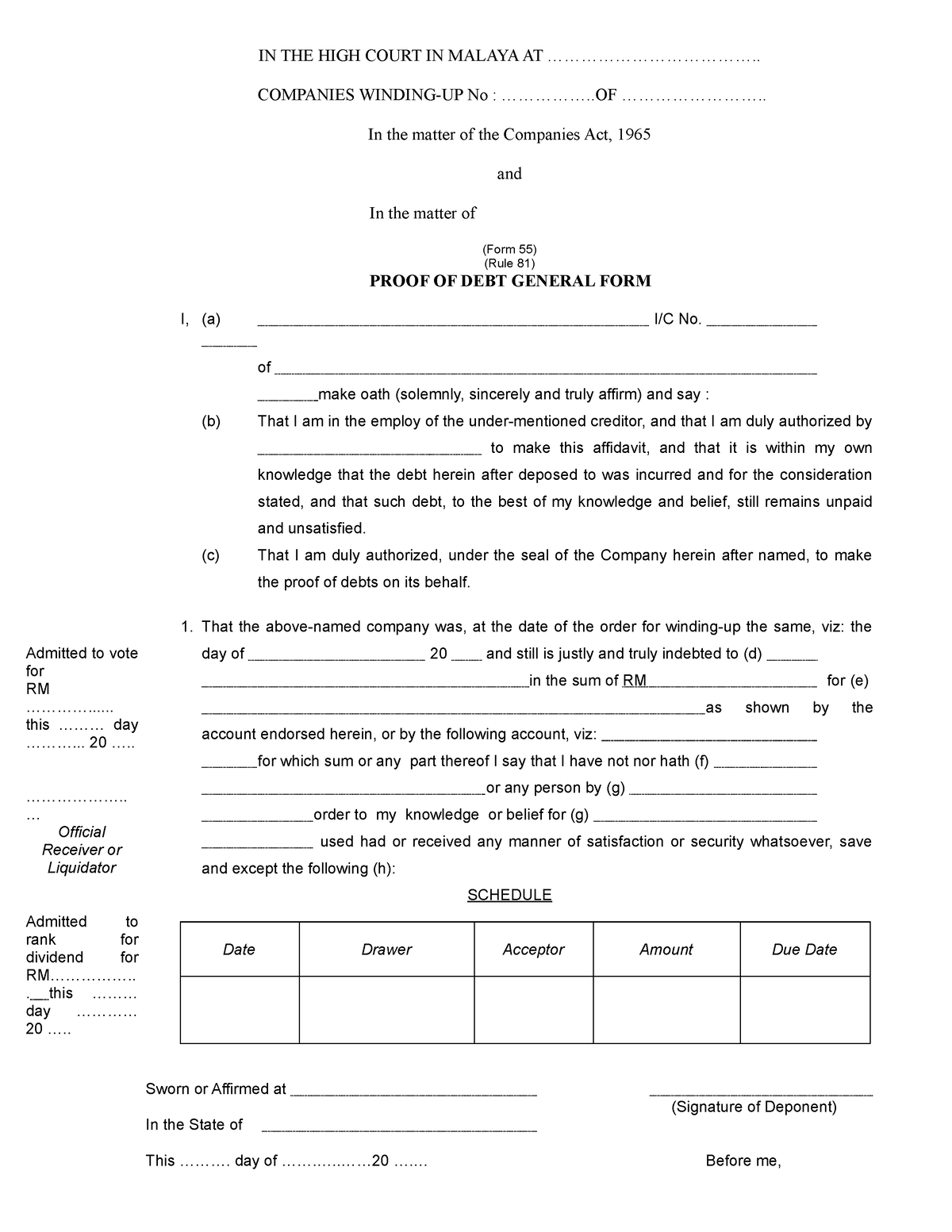

If your employer / company is in the process of winding up:

Employees terminated either through voluntary winding up or compulsory court-ordered winding up and any outstanding sums relating to:

- Wages or salary; and/or

- Worker’s compensation, remuneration, contributions in respect of vacation leave and contributions

can claim their unpaid wages by sending a proof of debt to the liquidator. A proof of debt is a document that lays out the amount of debts owing by a company to a creditor. The liquidator will then verify and, if approved, include the claim in the distribution of the company’s assets. A sample proof of debt provided by the Malaysian Department of Insolvency is seen below.

If the company’s assets are insufficient to cover the preferential debts, employees may not recover the full amount owed. However, the Director General of Insolvency (DGI) may step in to facilitate claims in cases where the employer is bankrupt as their role encapsulates the following functions:

- To examine, admit or reject partly or wholly the Proof of Debt;

- To declare and distribute dividend to the creditors.

4. What should I do when my employer fails to make my Employee Provident Fund (EPF) payments?

You may lodge a complaint at the nearest KWSP from you if your employer fails to contribute to your statutory EPF contribution. You will need to present the following documents and information to support your complaint:

- Your personal information such as name, identification number and EPF number

- Your employer’s name, contact number and address

- The contract of service between you and your employer, if any

- Your tenure with the employer

- Total salary paid to you

- Total EPF contribution deducted from your salary

- A copy of your pay slip with details of your EPF contribution deductions

- Other relevant documents (if any)

After a complaint has been made, KWSP will help investigate the matter and will send their officers to your company to investigate. Further measures may be taken by KWSP against company directors such as pursuing civil and criminal actions or even submitting the names of the company directors to the Immigration Department to prevent them from leaving Malaysia without paying its due contributions and in line with Section 39 of the EPF Act 1991.

5. Conclusion

It is important for you, whether as an employer or employee, to throughly understand your respective rights and obligations generally or during an employer liquidation or winding-up scenario and this includes understanding key legal provisions, such as the priority of wage claims and protections under Section 527 of the Companies Act 2016 and to seek professional legal advice or contact the relevant authorities when any of the above challenging scenarios arises.

Stay tuned for Part 3, where we will delve into corporate liabilities and obligations on taxes.

Legal Disclaimer:

Information and content contained in the article are for general information purposes only and are not intended as professional legal advice nor should you rely on any information, statements or representations made within this article or within the Ying & Partners Website as legal advice. If you have any specific queries or require any legal advice, please contact us or fill in the contact query form and we will get back to you at the earliest convenience.